Introduction

In our rapidly evolving world, technology plays a pivotal role in shaping how we connect, learn, and manage our health and finances. However, despite these advancements, many face challenges in accessing quality education, healthcare, and financial services. Issues of equity and efficiency often leave underserved communities behind. Fortunately, technology is stepping in as a bridge to address these gaps. By understanding and leveraging these tools, we can work towards sustainable development, ensuring everyone has the opportunity to thrive.

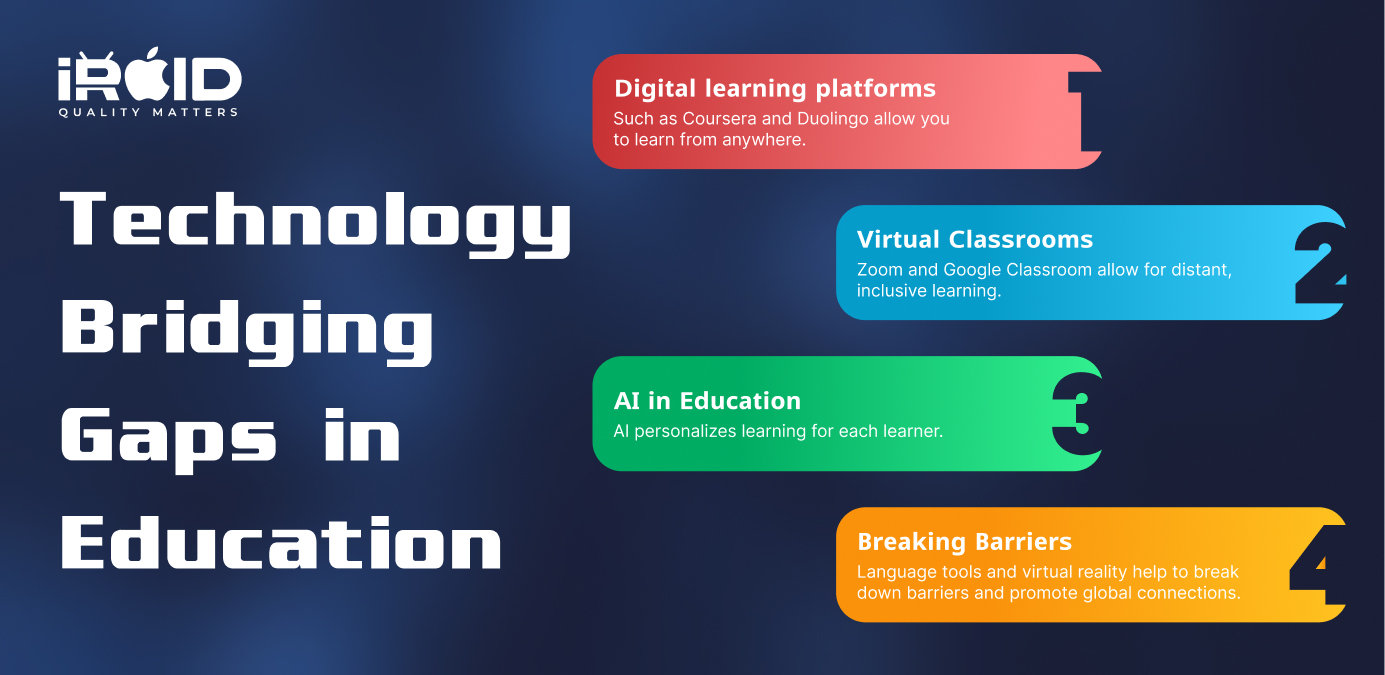

Section 1: Technology Bridging Gaps in Education

1.1. Digital Learning Platforms

E-learning platforms like Coursera, Khan Academy, and Udemy have transformed how we perceive education. They offer a variety of courses that make quality education accessible to anyone with an internet connection. This is especially beneficial for those in underserved and rural areas where educational resources are scarce. For instance, mobile apps like Duolingo have made language learning interactive and engaging, breaking down barriers for those without traditional classroom access.

1.2. Virtual Classrooms and Remote Learning

The pandemic has shown us the effectiveness of tools such as Zoom, Microsoft Teams, and Google Classroom. These platforms have allowed students of all abilities to continue their education from home. For students with disabilities or those in remote locations, virtual classrooms offer an inclusive environment where they can learn at their own pace without the constraints of physical attendance.

1.3. AI and Adaptive Learning Technologies

Artificial intelligence is personalizing education like never before. Chatbots and tutoring apps are helping students grasp complex subjects, while machine learning identifies knowledge gaps and tailors solutions. Imagine a student struggling in math receiving immediate, customized assistance to help them catch up—this is the future of personalized learning!

1.4. Bridging Language and Cultural Barriers

Translating tools and language apps make education more accessible across diverse backgrounds. Virtual reality (VR) is also a game-changer, providing immersive experiences that bring history or science to life. With such tools, students from different geographies can experience and learn about each other's cultures, fostering understanding and collaboration.

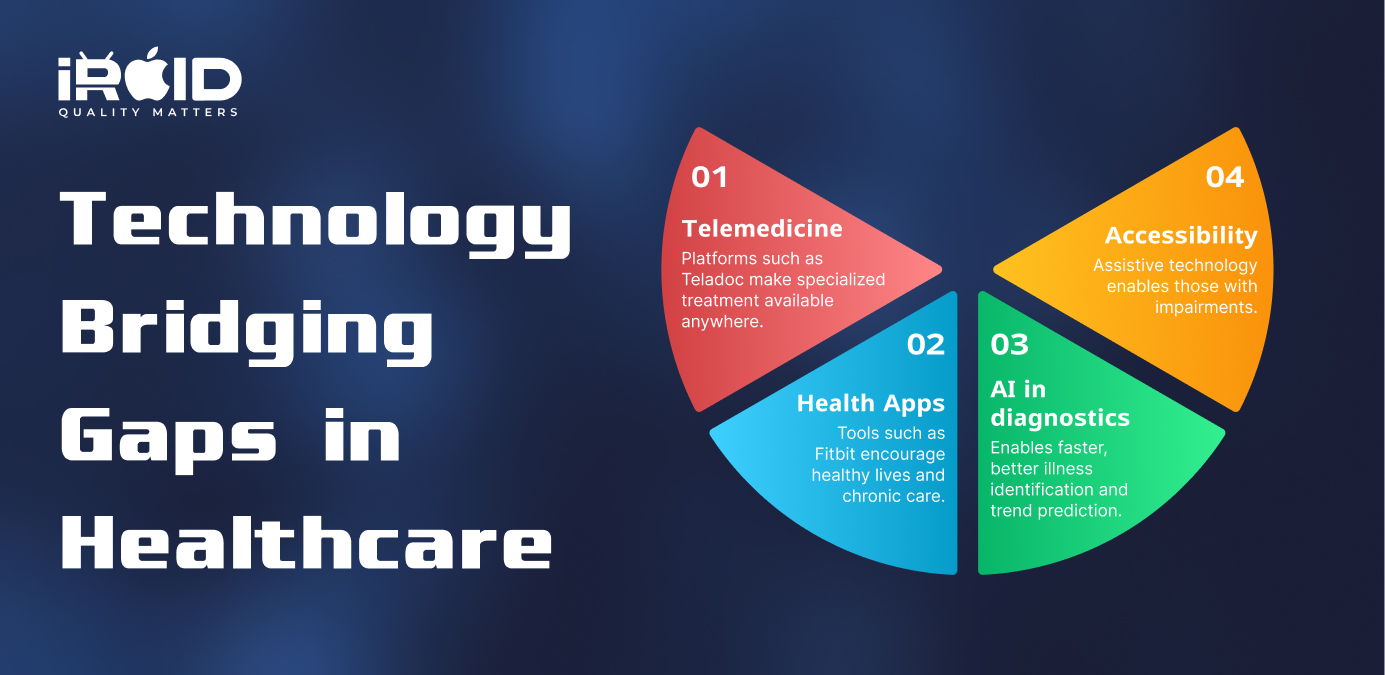

Section 2: Technology Bridging Gaps in Healthcare

2.1. Telemedicine and Remote Patient Monitoring

Telehealth platforms like Teladoc Health, Practo, and Amwell are helping people connect with specialists, particularly in rural and underserved areas. Imagine not having to travel hours to see a doctor; telemedicine makes healthcare more accessible than ever. Remote patient monitoring also allows healthcare professionals to track patients' conditions at home, providing timely intervention when necessary.

2.2. Health Apps and Wearable Devices

Health apps such as MyFitnessPal, along with wearables like Fitbit, are equipped for preventive healthcare. These tools can monitor chronic diseases and encourage healthier lifestyles, ensuring that individuals take proactive steps toward their wellbeing. Personal health management has never been more straightforward.

2.3. AI and Big Data in Diagnostics

The use of AI tools in diagnostics has revolutionized how we detect diseases. Tools like IBM Watson for oncology can provide faster and more accurate diagnoses. Additionally, big data analytics allow healthcare providers to predict trends and manage public health crises effectively, as seen during the COVID-19 pandemic.

2.4. Enhancing Accessibility for People with Disabilities

Assistive technologies, such as hearing aids, prosthetics, and screen readers, are crucial for improving the quality of life for people with disabilities. Mobile apps designed for daily health management empower individuals to take control of their care and facilitate communication with healthcare providers.

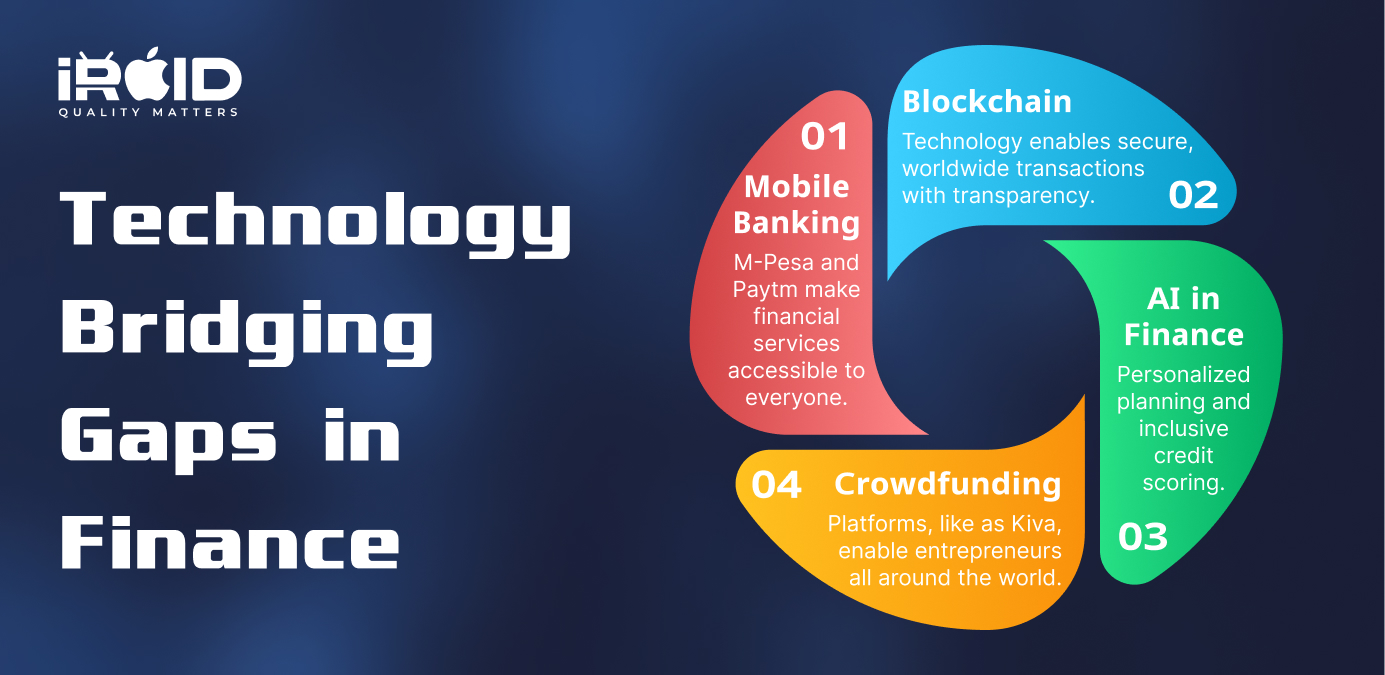

Section 3: Technology Bridging Gaps in Finance

3.1. Financial Inclusion Through Mobile Banking

Mobile banking solutions like M-Pesa in Africa have changed the game for unbanked populations. These apps empower individuals to transfer money, pay bills, and access financial services without traditional banking infrastructure. Digital wallets such as Paytm, Venmo, and Alipay also make managing money seamless and accessible.

3.2. Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies have opened doors to decentralized financial systems. This means more opportunities for global transactions with enhanced transparency and security, allowing trust in financial practices across borders.

3.3. AI in Financial Planning and Credit Scoring

With the rise of AI, financial planning is becoming more personalized. Robo-advisors can tailor investment advice based on individual needs and risk profiles. Alternative credit scoring systems also help traditionally underserved populations secure loans, democratizing access to capital.

3.4. Microfinance and Crowdfunding Platforms

Microfinance and crowdfunding platforms, like Kiva and Kickstarter, bridge the capital gaps for small businesses and entrepreneurs. By leveraging technology to simplify the lending process, both borrowers and lenders can connect and thrive in ways that were previously unimaginable.

Section 4: Common Benefits Across Sectors

4.1. Improved Accessibility

Technology has significantly reduced geographic, financial, and physical barriers, making education, healthcare, and finance more reachable to everyone.

4.2. Cost Efficiency

The automation and scalability of technology have drastically cut costs, allowing for more efficient allocation of resources across sectors.

4.3. Enhanced User Experience

Intuitive apps and platforms improve user engagement and satisfaction, ensuring that people not only have access but also enjoy a positive experience while using these services.

4.4. Data-Driven Decision Making

Big data and analytics enable informed decision-making, leading to better outcomes in each sector. Organizations can make strategic choices based on real-time data, adapting to the needs of the communities they serve.

Section 5: Challenges and the Road Ahead

5.1. Digital Divide and Inequality

Despite the progress, a digital divide remains real, with many lacking access to reliable devices and internet connectivity. It’s essential to focus on bridging this gap so that everyone can participate in the digital world.

5.2. Data Privacy and Security

With great power comes great responsibility. Handling sensitive data in education, healthcare, and finance raises privacy and security concerns. Implementing robust strategies to safeguard this information is crucial for building trust in these systems.

5.3. Need for Policy and Regulation

To ensure the ethical and inclusive use of technology, policymakers must establish clear frameworks. These regulations will guide both organizations and individuals to make responsible choices, ultimately fostering a supportive environment for innovation.

Conclusion

In conclusion, technology is playing a revolutionary role in closing inequalities in education, healthcare, and finance, empowering underrepresented groups and encouraging equitable access to critical services. While difficulties such as the digital divide and data privacy concerns persist, ongoing innovation and wise regulation of technology can pave the way for a more inclusive and efficient future. At iRoid Solutions, we are committed to using technology to build meaningful solutions that generate good change. For more information on how we can help your business expand with technology, please contact us at iRoid Solutions Contact.

Blog Related FAQs:

Technology enhances education through e-learning platforms, virtual classrooms, and AI-based adaptive tools, making quality learning accessible globally, especially in underserved areas.

Telemedicine connects patients with doctors remotely, reducing the need for travel and providing timely care to individuals in rural or underserved regions.

Mobile banking enables unbanked populations to access essential financial services like money transfers, bill payments, and savings without relying on traditional banking systems.

AI enables personalized learning in education, predictive diagnostics in healthcare, and tailored financial planning in finance, streamlining services for users.

Assistive technologies like screen readers, prosthetics, and specialized health apps enhance accessibility, ensuring equal opportunities in education, healthcare, and financial management.

iRoid Solutions develops tailored tech solutions to address gaps in education, healthcare, and finance, enabling businesses to expand their impact and foster innovation.

Recent Blog Posts

Get in Touch With Us

If you are looking for a solid partner for your projects, send us an email. We'd love to talk to you!